Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Discover office equipment financing options tailored for me. Elevate productivity with top picks for reliable tools!

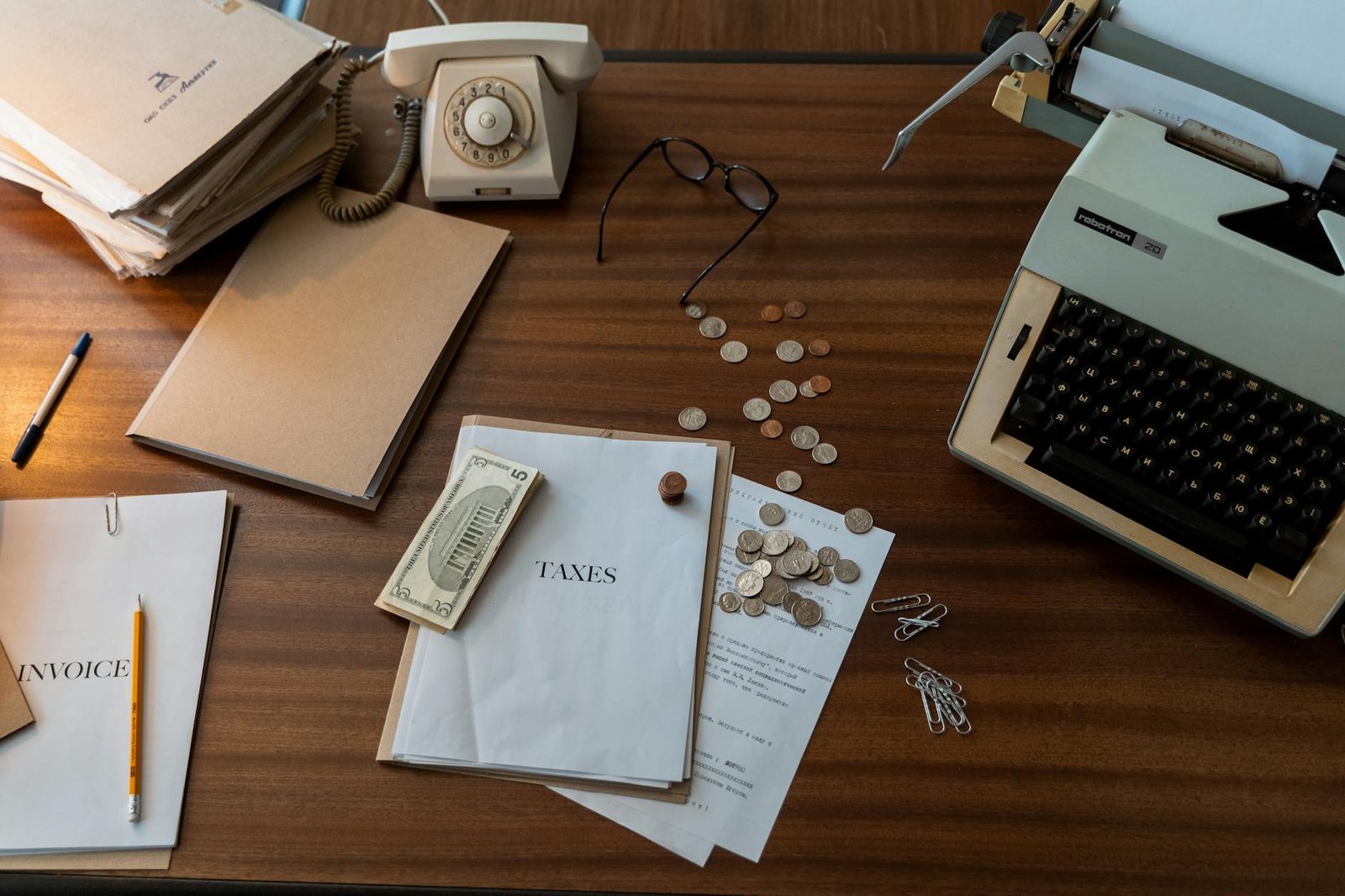

Ever stared at a blank finance form and thought, “Which box do I tick first?” So here’s the thing, office equipment financing can feel like deciphering a secret code full of acronyms, fine print, and confusing rates. I get it—whether you’re a freelancer outfitting a home office or a small business manager upgrading an entire floor, you need reliable printers, scanners, and projectors without draining your cash flow. When I first explored office equipment financing, I felt buried under applications and pushy sales pitches. But after trial and error, I’ve landed on strategies and providers that truly work. In this guide, I’ll walk you through my step-by-step approach and share my top picks, so you can equip your workspace with confidence.

Before you dive into lenders and loan terms, it helps to get laser-focused on exactly what gear you need and why. I’ve learned the hard way that skipping this step leads to overpaying for features I never used or under-sizing my purchase and regretting it later. Here’s my process:

Here’s a thought … grabbing an office equipment checklist can keep all this info in one place, so you’re not hunting through emails or scribbled notes when it’s time to shop.

That being said, there’s no single best way to fund our office upgrades. I break it down into these core routes, each with its own perks and trade-offs:

| Option | Ownership | Term length | Typical down payment | Best for |

|---|---|---|---|---|

| Traditional bank loan | Yes | 1–5 years | 10–20% | Established businesses |

| Equipment finance loan | Yes | 2–7 years | 0–10% | Faster approval than banks |

| Equipment leasing | No (lease term) | 2–5 years | 0–10% | Lower monthly payments |

| Rental | No rental period | Month-to-month | None | Short-term or project-based use |

| Business line of credit | No | Revolving | None | Flexible, multipurpose funding |

| SBA-backed loan | Yes | 5–10 years | 5–15% | Lower rates, government support |

Here’s a quick breakdown of pros and cons:

By lining up our priorities—ownership versus flexibility, speed versus rate—we can narrow the field before talking to lenders.

After comparing structures, here are the specific providers I’ve found most reliable. Each has its niche, so think about your business size, timeline, and credit profile.

When I worked with my regional bank, I appreciated sitting down face-to-face and hashing out terms. If you have at least two years of revenue and a solid credit score (usually 680+), you can land interest rates in the 5–8% range. The downside is the 2–4 week approval timeline and collateral requirements, but I liked knowing I owned the printer outright from day one.

Platforms like BlueVine, Fundbox, and Kabbage have saved my bacon when cash was tight. I’ve completed applications in under an hour and seen funds in a couple of days. Credit score minimums hover around 600, and APRs can run 9–30%. It’s a trade-off I’ll make for speed, especially when I’m rolling out new equipment mid-project.

Specialists such as LeaseQ and Columbia River Financial design their contracts for tech refresh cycles. My favorite part is the built-in service options—you lease a copier, and toner replacements or minor repairs are covered. I’ve used this for multifunction machines and projectors. Just remember you’re paying for depreciation plus interest, so the total cost can exceed a purchase loan.

Some of the big office equipment manufacturers like HP, Canon, and Xerox run in-house plans. Promotional 0% financing for 6–12 months is common. I snagged a bundle deal on printers and scanners once this way. The catch? You’re often locked into that brand’s service network and may face higher rates after the promo period.

For small businesses aiming for rock-bottom rates, the SBA 7(a) program is a sleeper hit. My accountant friend secured a 7-year loan at just 4.5% APR, with a 5% down payment. The process took six weeks and a stack of documents, but long-term savings were worth it if you can handle the paperwork.

Once you’ve chosen a lender, gathering documentation early makes the process smooth. Here’s my go-to checklist:

That being said, if a lender asks for something you don’t have—like a lease history—ask if they’ll accept a cosigner, personal guarantee, or alternative proof of income. In my experience, transparent communication speeds up approvals.

Signing on the dotted line is just the beginning—staying organized and protecting your investment delivers real peace of mind. Here’s how I keep everything on track:

Choosing the right way to fund your office gear comes down to balancing speed, cost, and flexibility. By defining our needs, lining up financing structures, vetting providers, and staying on top of payments, we can secure the tech that powers our best work. Trust me, you’re not alone in this. Each step—from filling out that first form to celebrating a successful installation—gets easier when you know what to expect. Here’s to equipping your team with confidence and keeping cash flow healthy along the way. You’ve got this!